Visa provides two services in the form of APIs to help improve cardholders’ travel experiences by reducing unnecessary purchase declines and by assisting the traveler when cash becomes a necessity in an unfamiliar setting. The following is an overview of these two services and a view into their implementation.

Visa Travel Notification Service

Credit card holders may appreciate helpful services they receive from their financial institutions that improve their travel experience. While cardholders may be concerned about protection from fraudulent charges, there is a flip side. Travelers can face having a purchase declined because the charge is outside of normal range or in another country.

Visa provides an easy-to-use service, the Visa Travel Notification Service, that helps card issuers avoid charges and unnecessary declines by using travel plan information provided by their cardholders. These self-reported travel plans are then used to help reduce unnecessary purchase declines, which can more likely result in a satisfied customer and a reduction of unhappy calls to customer service call centers.

For the cardholder, the process is as easy as self-reporting travel plans either online or by contacting the call center. For card issuers, implementation of this service can provide higher confidence in the validity of the charge before it is processed.

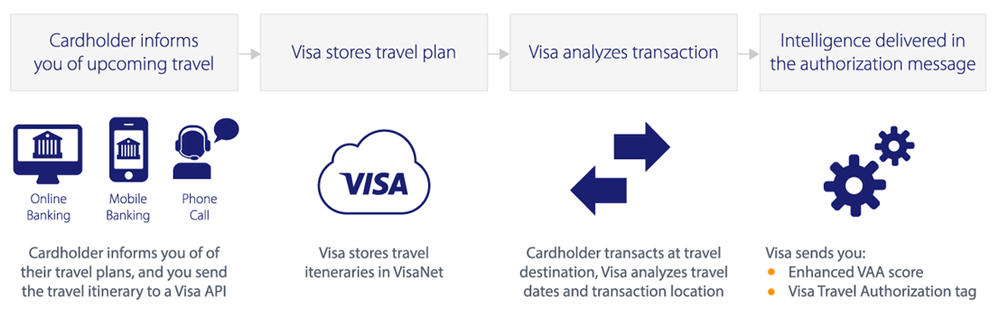

How It Works

As seen above, the cardholder provides dates and locations of travel to the card issuer. The card issuer then relays this information to Visa using the Visa Travel Notification Service API. Both Add Travel Itinerary and Update Travel Itinerary procedures are used to notify Visa of projected travel dates and locations. Visa then stores that information, and when that card holder makes a purchase, the travel locations and dates are used to perform real-time analysis of that transaction, confirming that the date and location of the charge aligns with the card holder’s reported travel plans.

This gives Visa the ability to send financial institutions an enhanced Visa Advanced Authorization Score, adding the travel information to the score and populating the Visa travel Authorization Tag in the “VisaNet” authorization message. Servicers can then use this information to determine the authenticity of the charge.

For information about authentication, security or to begin the production on-boarding process, contact developer@visa.com.

Note: The Visa Travel Notification Service only impacts the Visa Advanced Authorization score if you are an issuer in the United States or Canada

Locate Nearby ATMS Globally

Visa provides another service that enhances a cardholder’s travel experience by allowing them to find a nearby, trusted ATM. Many travelers might feel at a loss without their credit card, especially when visiting countries using unfamiliar currency, because using a credit card may allow them to set aside concern about currency identification and exchange rates. However, there are times when a traveler encounters a situation where a store or shop, or in worst case scenarios, a clinic or hospital, does not accept credit cards, and the traveler has a need for currency.

When a Visa cardholder needs cash, the Visa Global ATM Locator service provides the cardholder the ability to find a convenient ATM. The Visa Global ATM Locator API enables the cardholder, using internet-enabled devices, to search for over one million Visa/Plus ATMs in over 200 countries in the following regions around the world: North America, Asia Pacific, Europe, CEMEA and LAC.

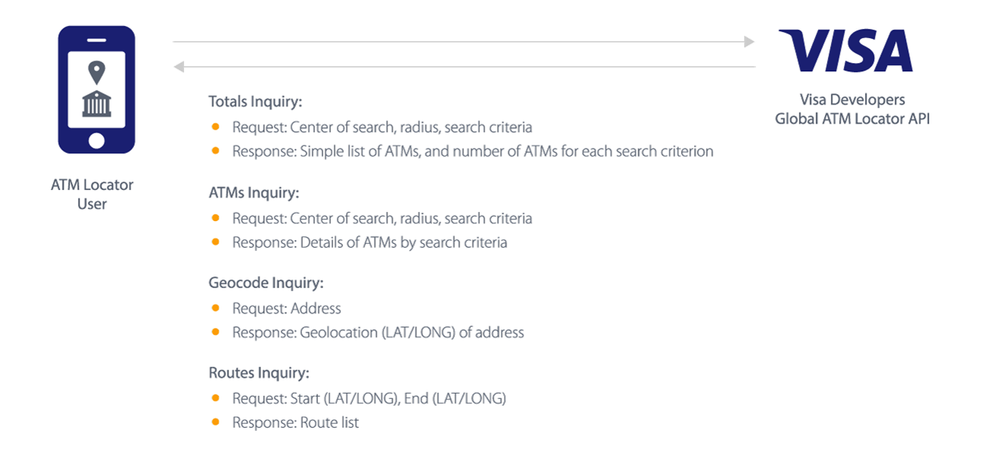

Implementation of the Global ATM Locator service for care issuers’ cardholders follows this process:

- Obtain the location where the customer wants to search for available ATMs, using a street address or geo-location of the customer’s mobile phone.

- Refine the search using other criteria for the ATM such as hours, accessibility, etc.

- Use the “Totals Inquiry” operation to check the number of ATMs that meet the user’s search criteria. This operation should be used before requesting the complete list of ATMs and can be used in multiple iterations in order to further refine search criteria and aid in formatting displays or allocating memory resources.

- Now request the detailed list of ATMs with the “ATMs Inquiry” operation, using the refined search criteria developed with “Totals Inquiry”.

- Display the list and allow the user to select the best fit from among the ATMs in the list.

- Finally, provide the user with the route from the current (or alternate) location to the ATM selected from the list by using the “Geocode Inquiry” to convert the local address(es) into a latitude and longitude. Then use the “Routes Inquiry” operation to provide walking or driving directions.

Note: Both the Geocode Inquiry and Routes Inquiry operations are provided by a third-party and may only be used in conjunction with the Global ATM Locator API. Any other use of these operations could violate the Terms of Use for the service. The Visa Global ATM Locator API includes the Locate ATMs API.

Have you experienced either a charge decline, or a need for cash while travelling in an unfamiliar country? If so, please share your experience.

Blog Written by guest contributor Carolyn Darity