How Visa In-App Provisioning Can Help Solve Your Digital Issuance Problems

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Introduction

It is no secret that the world has long been changing to be more digitally inclusive, and that technologies and society are moving to be mobile first. Payments are no exception to this trend, and consumers’ expectations for their payment experience are influenced by the many other products and services they consume as well. Social media has driven a desire for instant gratification and consumers expect real-time experiences. Moreover, consumers expect experiences to be automated as much as possible to reduce friction and repetitive activities. In addition, we see several other trends contributing to growing levels of mobile wallet penetration such as increased smartphone penetration, increasing merchant acceptance and an increasing preference among Gen Z for mobile experiences. As Visa and our clients look to the future and how we can succeed together, digital mobile experiences will be paramount to crafting a best in class experience for your cardholders.

What is Digital Instant Issuance and Push Provisioning?

Given the desire for immediate, digital experiences, instant issuance is one of the first things that comes to mind. Instant issuance happens when an issuer processes a card application in real-time and is able to then immediately approve and create card credentials for a customer. Instant issuance reduces the card application process from days or weeks to just seconds. This is a stark contrast to the traditional period of up to 10-14 days for which a customer would need to wait for their plastic card to arrive in the mail. However, while instant issuance delivers payment credentials to the customer, in reality those credentials may be limited in practical acceptance. In order for a customer to use their newly issued digital card, they need to provision those credentials to a mobile wallet such as Apple Pay, Google Pay or Samsung Pay in order to use them. Mobile wallets enable the customer to actually go out and make payments, thus, push-provisioning becomes critical to instant issuance.

Why do Instant Issuance and Push Provisioning Matter and Why Should You Be Thinking About It?

Times are changing and consumers are rightfully demanding faster and more seamless experiences, including payment experiences. Instant issuance coupled with push provisioning can help provide the ideal cardholder experience. And for issuers, can correspond to immediate and increased usage and card spend.

From both a practical and theoretical standpoint, instant issuance and push provisioning has shown to meet a consumer need. From a tangible standpoint, mobile wallet and mobile payment usage has grown dramatically across the world over the past 2 years. From October 2018 to August 2020, the percentage of mobile phone users that made at least one proximity mobile payment has grown in every geographic region. In North America, this increase was 12%, Latin America, 5%, Western Europe, 5%, Eastern Europe, 4%, the Middle East and Africa, 4%, and the Asia Pacific, 3%. These percentage increases are indicative of shifts in consumer behavior, shifts handled by digital issuance. (Asia Pacific Online Payment Methods 2019: http://kcenter.visa.com/Documents/Subscriptions/yStats/yStats-Asia-Pacific-Online-Payment-Methods-20...)

From an issuing perspective there are tangible benefits to pushing card credentials to mobile wallets. Studies have shown that on average, after adopting mobile wallets, the total transaction amount increased by 2.4% and that the total transaction frequency increased by more than 7.14% within the scope of the studies. (Mobile Payment Adoption: An Empirical Investigation on Alipay, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3270523 )

What is Visa In-App Provisioning and How Does it Work?

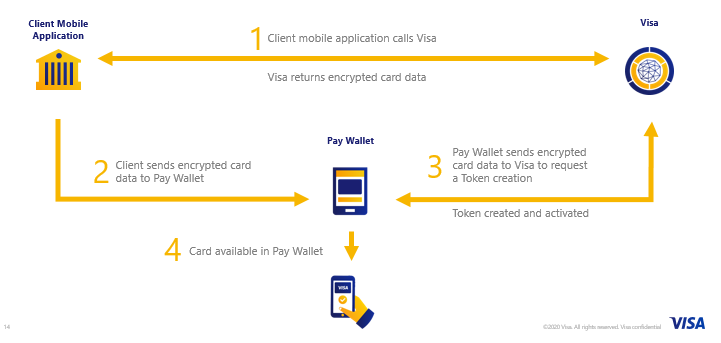

With In-App Provisioning, eligible cards can more seamlessly be added to digital wallets from within an issuer’s mobile banking app. With the Visa In-App Provisioning API or SDK, issuers can easily implement push-provisioning to Apple Pay, Google Pay, or Samsung Pay. Rather than having to deal with identifiable card numbers and card information, issuers are provided with an encrypted card data payload that's formatted for the selected mobile wallet based on the cardholder device. This helps reduce the need for intense software complexity and the server and security structure required to store encryption keys, as this is handled by Visa.

In-App Provisioning also helps make it easier for developers and fintechs to participate in the mobile payments space. Visa stores the BIN sponsor encryption keys, the cardholder environment doesn’t include PAN numbers and other similarly sensitive information, and the cards themselves are provisioned without card numbers, so fintechs –who may be generally limited by data privacy regulations-- might be able to participate where they could not before. This also shows Visa’s dedicated and consistent commitment to aiding fintechs and promoting innovation in the payments space.

How Can In-App Provisioning Help Solve Your Problems?

In-App Provisioning allows for cardholders to provision their eligible card in their participating mobile wallet and start making transactions . Cardholders that have an existing account with an issuer but do not have a card, can login to their mobile banking app and easily add a new card to their mobile wallet. If a cardholder has an existing physical card with an issuer but not a digital card in their pay wallet, they do not have to physically scan the card or manually enter PAN details, rather In-App Provisioning allows for cardholders to push a button and have the card more seamlessly added to their pay wallet. If a customer applies for a new credit card and is approved, with In-App Provisioning the client has instant issuance capabilities: The card can be instantly issued to the new customer, and the card credentials can be immediately pushed to the pay wallet foruse by the customer. All of these use cases currently work with Apple Pay, Google Pay, and Samsung Pay. If you have any of these use cases, then Visa In-App Provisioning can help make life a lot easier.

Without In-App Provisioning, digital issuance can be difficult, lengthy, and cumbersome. For instance, each participating pay wallet has its own requirements and specifications for integration and encryption, requiring three unique software solutions for integration and time to market can take months. Without Visa In-App Provisioning, issuers generally have to generate double encrypted card payload per Visa and pay wallet specifications, processes that can come with high software development costs. Issuers would also have to have software and hardware solutions for storing and managing encryption keys, and would be responsible for maintaining wallet endpoints, which can be challenging due to changing wallet mandates and consistent wallet updates. With In-App Provisioning, Visa helps address these challenges and issuers can be up and running more quickly.

Footnote: Issuer participation in the Visa Token System and Issuer enrollment of the relevant issuer identifier ranges with the relevant pay wallets are required. Third party brands or trademarks are the property of their respective owners, used for illustrative purposes only and do not imply and endorsement or partnership.

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.