How to test and troubleshoot APIs with the Visa Developer Center Playground

We feel that the Visa Developer Center has come full circle since launch in 2016. It hosts many APIs...

By Ahmed Siddiqui, VP of Product Management at Marqeta

(If you want to learn more about the payments ecosystem or ask any questions you may have in real time, Ahmed will be covering this and more in the Payments 101 for Developers Webinar 4/3 at 11am. Tune in and ask the questions you want answered on the payments ecosystem. Registration details here)

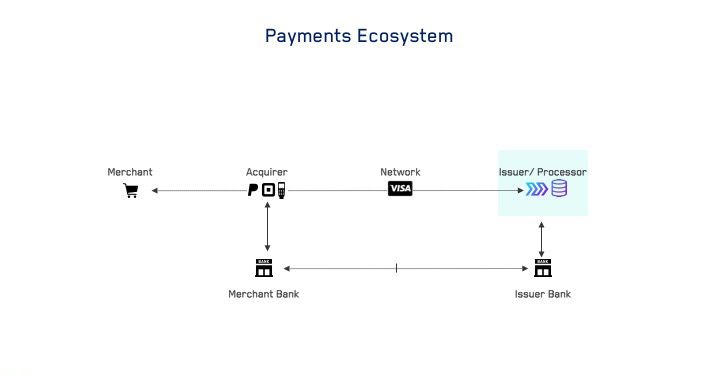

The payments ecosystem always starts with people who want to buy things from other people. Historically these people would use cash, but now more and more people are moving to pay with cards - be it credit, debit, or prepaid cards. These cards are typically issued by an Issuer or Issuing Bank. However, these cards are useless unless Merchants are willing to accept them. In order to accept cards, you need a terminal. Terminals are provided by Acquirers or Gateways. Behind an Acquirer is always a Merchant Bank that receives funds. The transmission protocol or “rails” is managed by Networks such as Visa.

When a consumer swipes, dips or taps their method of payment at the Merchant terminal, this starts the authorization process. This usually takes less than three seconds, but a lot happens in that time. After a card is swiped at the terminal, the Acquirer takes information off of the card and determines it is a Visa card. The Acquirer then calls Visa and sends data over via an ISO 8583 message (the International Organization for Standardization’s standard for systems that exchange electronic transactions initiated by cardholders using payment cards), asking the Network if the customer is actually allowed to transact.

Visa receives the ISO 8583 message from the Acquirer, and takes note of the card number. Based on the card number, Visa routes a message to the Issuer Processor of the card. The Issuer Processor receives the message, parses the ISO 8583 message and evaluates the message based on pre-set rules in the system typically determined by the Terms of Service with the Issuing Bank. These rules can include:

Depending on what comes back the Issuer Processor then makes a decision to approve or deny the transaction. This decision is then sent back to the Network. The Network relays this back to the Acquirer, and the Acquirer renders the response on the terminal.

Assuming a cardholder’s transaction goes through, Merchants will initiate the settlement process (if required) at the end of the day, to move their daily transactions to the Network. The Network will then request money from the Issuing bank, and the Merchant could receive their money as soon as the next business day. A small piece of the money that is moved to the Merchant bank is distributed to all parties in the Payment Ecosystem (the Acquirer, Issuer and the Network). Called Interchange, this is done in order to cover the cost of convenience to customers wishing to pay with cards.

In the event that Marqeta issued the card being used, Marqeta can generate a clean JSON out of the ISO 8583 message that can be easily read by developers during the transaction. The developers can also take action based on the data received -- all within the three second authorization time window. Some of the things Marqeta knows about a transaction include:

There are other opportunities in Issuing Processing that developers can take advantage of by using Marqeta’s modern open API payment card issuing platform.

Marqeta gives you the ability to create your own physical, virtual or tokenized cards. In addition to enabling card creation, Marqeta gives companies the opportunity to authorize their own transactions. Some parameters are pre-set, such as spend limits, company restrictions, and Merchant type restrictions. Through Just-in-Time “JIT” Funding (real-time funding of user accounts at time of purchase, enabling customers to maintain cards at $0 balance), Marqeta is able to pass data over to the company so that they can make real-time decisions on just about anything like time of spend, geolocation, total spend amount, etc. This enables companies to control where card users are spending money and helps reduce fraud to near zero.

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

We feel that the Visa Developer Center has come full circle since launch in 2016. It hosts many APIs...

In this developer guide, we will show you how to test Message Level Encryption (MLE) enabled APIs us...

First time to the Visa Developer Center? Watch this tutorial to learn where to find the Visa APIs th...

Watch the recording of my How to Run a Visa Direct Transaction using Python webinar as you follow al...